Brooklyn, December 8, 2015

There are retribution attacks against Muslims going on right now in a couple of isolated places in America. They are isolated, and no deaths yet.

These are being goaded on, in the far right-wing media, by an extremist ideologue named Donald Trump. He is the archetype of the Ugly American abroad. But this Ugly American has a global platform to broadcast a Nativist Capitalist Egoist extremist ideology: this is fascism, American-style. In broadcasting this extremist ideology, he is implicitly involved –– other Republican legislators are *explicitly involved* –– in inciting violence against Muslims, creating a favorable sales environment (as we like to say it in advertising) for ISIS.

Christians, especially, should recognize both the wisdom and the futility in the phase, “What goes around comes around.” These are not retribution attacks against Muslims, or Muslim-Americans. Not murders of black kids and murders of cops. These are attacks and counter-attacks against Americans. We must begin to perceive the terrorism we commit upon each other. ISIS wants us to be blindly enraged extremist ideologues just like them.

We look like we’re obliging them.

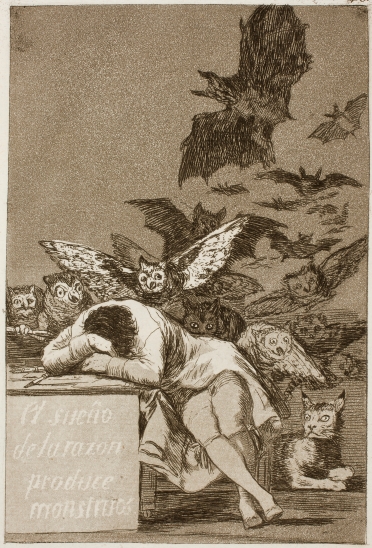

Have we, as Americans, truly had such a poor education that we cannot understand this?

Donald Trump’s supporters are themselves directly supported by fear and the feeling of failure. It’s written into Trump’s slogan. They are formed of white men aggrieved, frightened into their small cultural ball, assaulted on all sides by forces of economics, religion, sexuality, gender, race, culture and violence – all projected to them in extremis, by a propaganda organ called Fox News.

When those fears, and those feelings of failure, are vectored toward minorities, toward refugees of war, toward the weak in society, violence is an inevitable consequence.

Americans do terrorism upon themselves. That is the lesson of the San Bernardino terrorists. It is the lesson of the Charleston church murderer and the Planned Parenthood killer and the college shooters and all the rest.

Donald Trump is creating an environment for terrorism to escalate. The leading candidate for the Republican nomination is willfully endangering U.S. national security and the security of innocent American civilians.

Talk about voting against your own self-interest.

Okay, it’s like this. The main reason we’re in a Great Recession is that, back in 1999, the U.S. government compromised itself to death. Bill Clinton wanted to increase lending to minorities. The Republican-controlled Congress (swept into office by Newt Gingrich’s “Contract with America”) said, “Only if you decrease regulation at the same time,” and so

Okay, it’s like this. The main reason we’re in a Great Recession is that, back in 1999, the U.S. government compromised itself to death. Bill Clinton wanted to increase lending to minorities. The Republican-controlled Congress (swept into office by Newt Gingrich’s “Contract with America”) said, “Only if you decrease regulation at the same time,” and so